|

|

ADVERTISEMENT

Buy Your own advertising

spaces!

.

Download Adobe Acrobat Reader to open [PDF] files.

Recent Visitors

Merger talks fuel interest in two Shanghai carriers

2009. 5 June

by Wang Ying (chinadaily.com.cn)

Rumors about the impending merger of two Shanghai-based carriers, China Eastern and Shanghai Airlines have been doing the rounds despite denials by managements of both the companies.

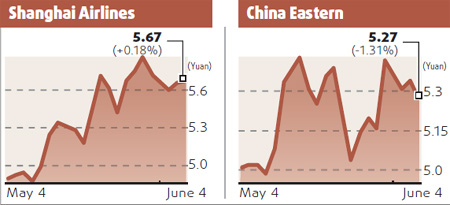

This time the rumors have been attributed to a journalist who claims to have overheard China Eastern Chairman Liu Shaoyong confirming the news at a recent dinner party. The incessant merger news has also had an impact on the share prices of the two carriers. Shares of the smaller Shanghai Airlines rose 0.35 percent to 5.67 yuan in the past three days, while those of the ailing ST China Eastern fell 1.86 percent to 5.27 yuan in the same period.

The incessant merger news has also had an impact on the share prices of the two carriers. Shares of the smaller Shanghai Airlines rose 0.35 percent to 5.67 yuan in the past three days, while those of the ailing ST China Eastern fell 1.86 percent to 5.27 yuan in the same period.

Analysts said despite the slight fall in China Eastern shares, both companies have gained from the rumors.

"The share prices of the two airliners showed that the market is expecting something big to happen. Otherwise, the two debt-stricken carriers cannot carry such a high price, or we can say they are over-valued," said Yao Jun, industry analyst, China Merchants Securities.

"It is true a merger between the two will be an opportunity for the carriers to get out of the current problems," Yao said.

The idea of merging the two airlines was first broached in 2002 by the Shanghai municipal government, as it was keen on building a superpower local carrier. Although the proposal has been dogged by political and inter-regional complicities, the stock market has never given up its imagination of a super airline based in China's busiest air traffic hub.

The latest merger rumors have been denied by both companies. Luo Zhuping, board secretary with China Eastern, said he has not heard of any new development on the merger front, while Xu Junmin, board secretary of Shanghai Airlines denied any knowledge of an impending merger. "Our airline has been operating normally as usual," he said.

Plagued by fluctuations in fuel prices and falling demand due to the financial crisis, the two carriers have required massive government bailouts.

Falling demand along with hefty losses on hedging contracts saw China Eastern report a net loss of 13.93 billion yuan in 2008, a free fall from previous year's 604 million. Its debt-to-equity ratio hit 115.13 percent by the end of March.

Shanghai Airlines is in no better situation, with its net loss widening to 1.25 billion yuan in 2008 from 2007's 435.12 million yuan. The carrier's debt-to-equity ratio touched 97.26 percent in March.

Analysts said that there are a number of ways that the two carriers could be restructured. China Eastern could acquire Shanghai Airlines or else downsize itself to a local enterprise controlled by the State-owned Assets Supervision and Administration Commission of the Shanghai government. There is a third proposal to merge selective assets of China Eastern and Shanghai Airlines.

The forthcoming World Expo 2010 will provide a golden opportunity for Shanghai-based carriers. If they can produce a win-win merger this time, they can benefit from the surging demand triggered by the expo, analysts said.

Li Lei, aviation analyst, CITIC China Securities, said: "China Eastern currently has a 33 percent share of the Shanghai market, while Shanghai Airlines holds around 20 percent. A merger would guarantee the dominant position in Shanghai for the resultant entity."

Source:www.chinadaily.com.cn